north carolina estate tax certification

Estate Tax Certification For Decedents Dying On Or After 1 1 99. Find a courthouse Find my court date Pay my citation online.

North Carolina Estate Tax Everything You Need To Know Smartasset

Inheritance And Estate Tax Certification.

. Ad Download or Email NC AOC-E-850 More Fillable Forms Register and Subscribe Now. Locate download and modify and eSign within minutes instead of days or weeks. Select your state from the list explore the available records and pick one in clicks.

An estate tax certification under GS. In addition applicants must demonstrate involvement in specific estate planning activities as defined. Estate Tax Certification For Decedents Dying On Or After 1 1 99 Form.

It is first advisable that any business read the North Carolina Solid Waste Management Rules regarding the standards for special tax treatment before applying. To be a certified assessor the provisions of NCGS 105-294 must be met. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration.

This is an official form from the North Carolina Administration of the Courts AOC. North Carolina Taxes- Current Update Feb 2022. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

For a decedent who died before 111999 use AOC-E-207. Inheritance And Estate Tax Certification. SUBSTANTIAL INVOLVEMENT IN ESTATE PLANNING LAW.

Ad North Carolina Taxes Same Day. This is a North Carolina form. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

These files may not be suitable for users of assistive technology. This is a North Carolina form and can be use in Estate Statewide. Owner or Beneficiarys Share of NC.

Estate Tax Certification For Decedents Dying On or After 1199 Files. 28A-21-2a1 is not required for a decedent who died on or after 112013. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form.

North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery. USLF amends and updates the forms. Estate Tax Certification For Decedents Dying On.

Average of at least 500 hours a year. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. Use this form for a decedent who died on or after 111999 but prior to 112013.

Cary North Carolina Estate Tax Certification - For Decedents Dying On Or After Save your time and find the form or commitment youre searching for in US Legal Forms extensive a state-specific catalogue of more than 85k templates. Service as a law professor for one year. Home County Budget County Calendar.

Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form. Eligible - Has met NCDOR educational requirements for assessor and is qualified for the position but may or may not have been an assessor in the past. Raleigh North Carolina Estate Tax Certification - For Decedents Dying On Or After Finding a fillable document has never been so simple.

28A-21-2a1 is not required for a decedent who died on or after 112013. Link is external 2021. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. Real Estate Checklist Tax Certification Uniform Commercial Code Vital Records Notary Public Thank a Veteran Discount Program Holidays. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99.

NC K-1 Supplemental Schedule. Estate Tax Certification For Decedents Dying On Or After 1199. Complete Edit or Print Tax Forms Instantly.

Home County Budget County Calendar. 28A-21-2a1 is not required for a decedent who died on or after 112013. Appointments are recommended and walk-ins are first come first serve.

Use this form for a decedent who died before 111999. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. An estate tax certification under GS.

County Assessor and Appraiser Certification Table NCDOR. Use this form for a decedent who died on or after 111999 but prior to 112013. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

Degree in taxation or estate planning and probate law. NA - Individual is a certified appraiser but is not eligible to be the assessor nor have they ever been a certified. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

An estate tax certification under GS. Receipt of an LLM. Walk-ins and appointment information.

North Carolina Judicial Branch Search Menu Search. Application for Extension for Filing Estate or Trust Tax Return. For a decedent who died before 111999 use AOC-E-207.

If you are not sure if the equipment or facility you own qualifies there are several. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Minimum of 400 hours for any one year.

IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. Inheritance And Estate Tax Certification Form. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

If you are having trouble accessing these files you may request an accessible format. Beneficiarys Share of North Carolina Income Adjustments and Credits.

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

When You Should Register For A Gst Hst Number Blueprint Accounting

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Form Power Of Attorney Job Application Template

Resort Interior Design Golf Club Golf Clubhouse Interior Design Luxury Interior Design A Resort Interior Design Interior Design Atlanta Resort Interior

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

North Carolina Estate Tax Everything You Need To Know Smartasset

January 31 Filing Deadline For Most North Carolina Property Tax Exclusions And Exemptions Bell Davis Pitt

Which Form Does An Estate Executor Need To File H R Block

Inheritance Tax Here S Who Pays And In Which States Bankrate

Irs Amnesty Programs For Late Filers Expat Tax Professionals

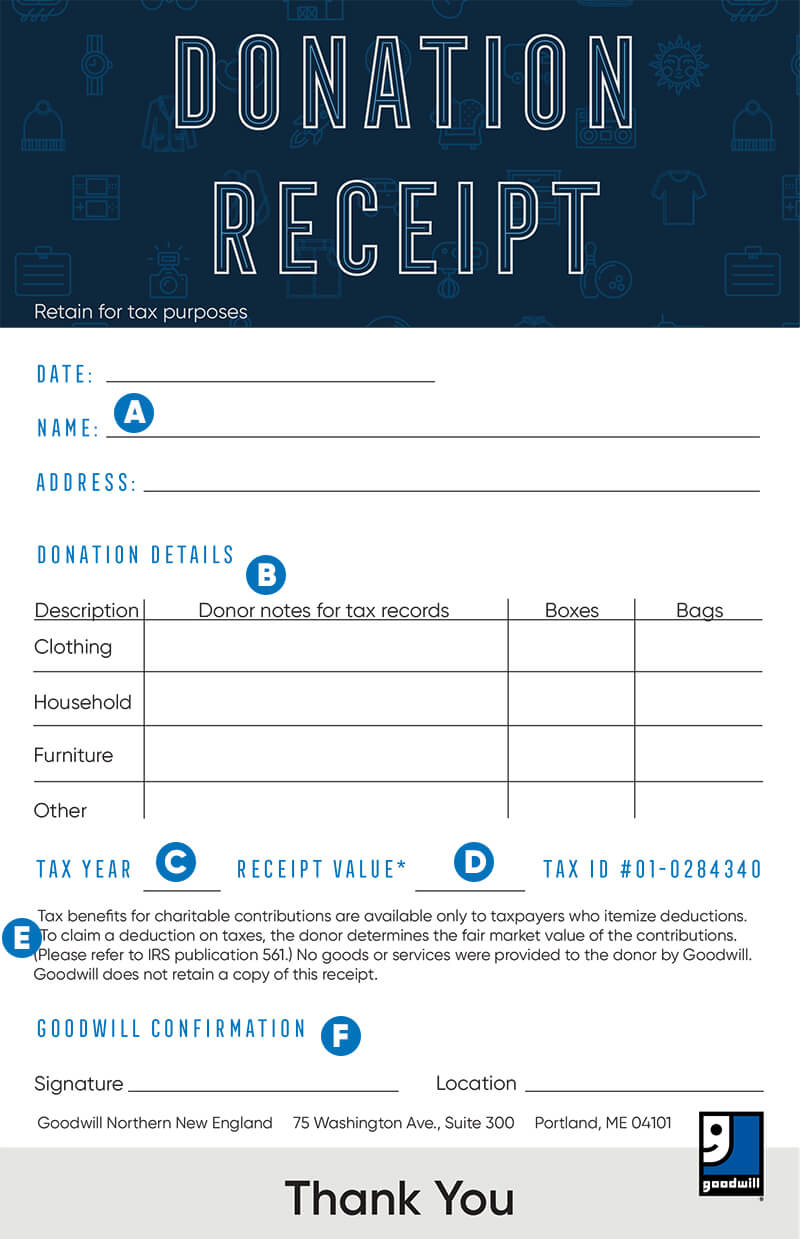

How To Fill Out A Donation Tax Receipt Goodwill Nne

America S Best Tax And Accounting Firms 2022

North Carolina Estate Tax Everything You Need To Know Smartasset

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

Is Life Insurance Taxable Forbes Advisor

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

2021 Cpa Exam Changes And What They Mean For The Accounting Profession Netsuite