colorado estate tax threshold

Whose tax payments may increase. Download the Corporate Income Tax Guide.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

In general the tax does not apply to sales of services except for those services specifically taxed by law.

. Colorado Cash Back. If youve already filed your Colorado state income tax return youre all set. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail.

Until 2005 a tax credit was allowed for federal estate. The exemption amount will rise to. Colorado imposes a tax on the income of any C corporation that is doing business in Colorado.

Even though there is no Arizona estate tax the federal estate tax may apply to your estate. Nonresident real estate withholding DR 1079. You would owe capital gains taxes on the 50000 that.

Recent Colorado statutory changes require retailers to charge collect and remit a new fee. The federal estate tax exemption is 1170 million for 2021 and. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

See what to expect. Colorado imposes sales tax on retail sales of tangible personal property. Do you make more than 400000 per year.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Youll receive your Colorado Cash Back check in the mail soon. One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. The taxpayers net Colorado tax liability minus all credits withholding and any sales tax refund is less than 1000. Whats the threshold for economic nexus law in Colorado.

In addition to having no estate tax Colorado also has no gift tax or inheritance tax. Heres a look at the Taxpayer Relief Act of 1997 and 1031 tax-deferred exchange rules in Colorado. Federal Estate Tax.

The tax applies generally to every C corporation. The following table outlines Colorados probate and estate tax laws. For 2021 the threshold for federal estate taxes was.

Small estates under 50000 and no real property. A state inheritance tax was enacted in Colorado in 1927. The taxpayer was a.

No estate tax or inheritance tax Connecticut. A state inheritance tax was enacted in Colorado in 1927. The Estate Tax is a tax on your right to transfer property at your death.

Some states do assess inheritance tax if the decedent passes away in a specific state even if. 100000year in gross revenue the previous calendar year. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Devisees or heirs may collect assets by using an affidavit. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

The bill changes the dollar threshold for economic nexus for purposes of retail sales made by retailers without physical presence in the state from 100000 to 200000. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Until 2005 a tax credit was allowed for federal estate.

Transfer On Death Tax Implications Findlaw

Colorado State Tax Guide Kiplinger

James Contini Column On Federal Taxes

Some States Are Moving To Loosen Their Estate Taxes The New York Times

State Death Tax Hikes Loom Where Not To Die In 2021

Do I Have To Pay Taxes When I Inherit Money

2021 State Corporate Tax Rates And Brackets Tax Foundation

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Colorado Estate Tax The Ultimate Guide Step By Step

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Trusts Lawyer Do You Really Need A Trust Denver Estate Planing Lawyer

Kansas Estate Tax Everything You Need To Know Smartasset

Estate Tax Protection Colorado Wills And Estates

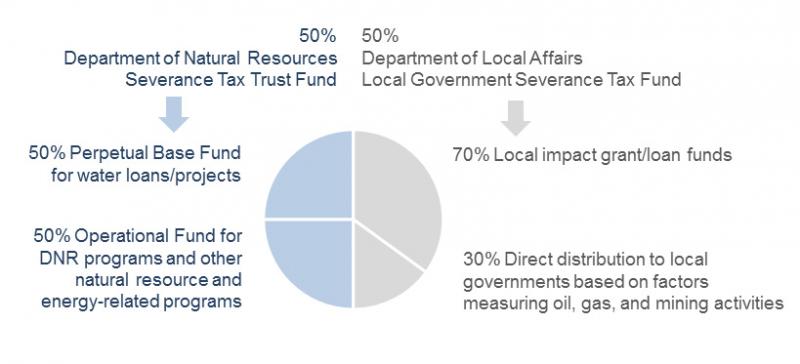

Severance Tax Colorado General Assembly

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

What Is The U S Estate Tax Rate Asena Advisors

Estate Tax Campaign National Committee For Responsive Philanthropy